IRS 1120-C 2025-2026 free printable template

Instructions and Help about IRS 1120-C

How to edit IRS 1120-C

How to fill out IRS 1120-C

Latest updates to IRS 1120-C

All You Need to Know About IRS 1120-C

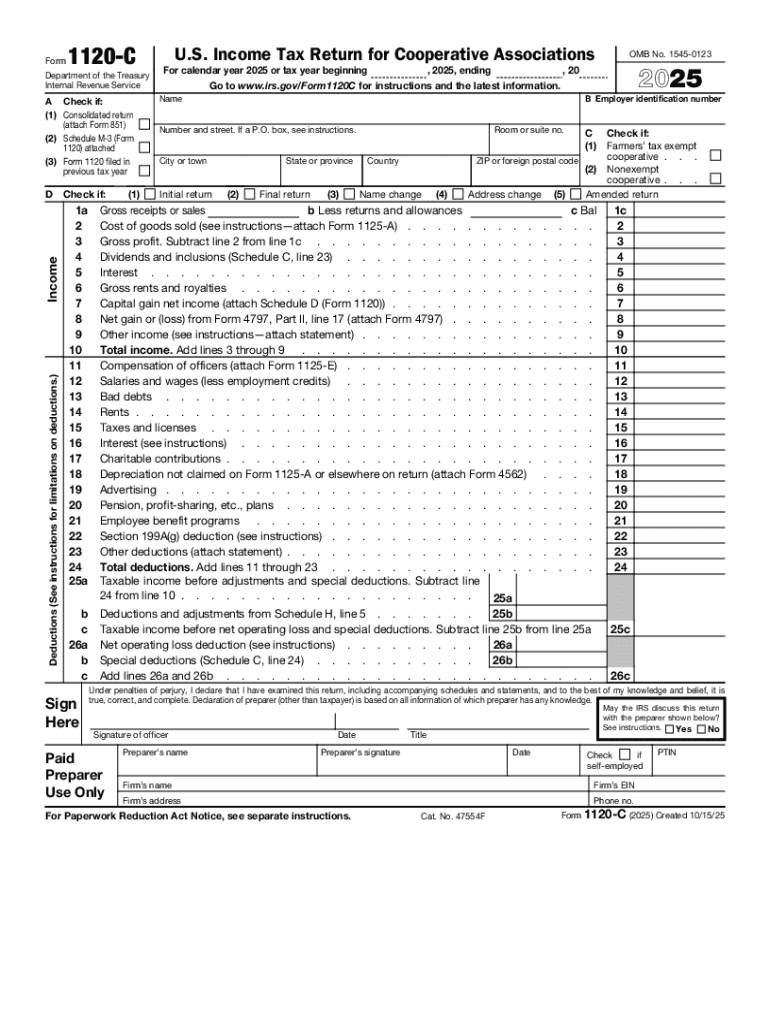

What is IRS 1120-C?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

Form vs. Form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120-C

What should I do if I realize I've made a mistake on my IRS 1120-C after submitting it?

If you find an error on your IRS 1120-C after submission, you should file an amended return using Form 1120-CX. This form allows you to correct any mistakes made in your original filing. Make sure to clearly explain the corrections made and retain copies of all documents for your records.

How can I check the status of my IRS 1120-C filing?

To verify the status of your IRS 1120-C filing, you can access the IRS's online services or contact their customer service. Keep in mind that it may take several weeks for the IRS to process your return, especially during peak filing seasons. Note any e-file rejection codes if your submission is not accepted.

What common errors should I avoid when filing my IRS 1120-C?

Common errors when filing the IRS 1120-C include incorrect tax identification numbers, miscalculations in income or expenses, and failing to include necessary schedules. To minimize errors, double-check all entries, ensure that all amounts are accurate, and follow the guidelines closely.

Can I e-file my IRS 1120-C, and what are the technical requirements?

Yes, you can e-file your IRS 1120-C using approved tax software. Ensure that your software is compatible with IRS e-filing systems. Check for any specific browser or device requirements and confirm that any electronic signatures meet IRS standards to ensure a smooth filing process.

What steps should I take if I receive an audit notice regarding my IRS 1120-C?

If you receive an audit notice concerning your IRS 1120-C, respond promptly by reviewing the notice details. Gather all relevant documentation and prepare a thorough response by the deadline indicated. It may also be beneficial to consult a tax professional for assistance in addressing the audit.